Description

There have been recent trade agreements between India and the UAE as well as Australia in order to support India's growing ambition to become a USD 1 trillion economy in 2030. For this objective to succeed, India intends to extend its reach to other Gulf Cooperation Council nations and to nations in the EU. These types of contracts would provide the economy with the manufacturing boost it requires to become a major supply center, resulting in business growth, job creation, and in turn enabling the economy to undergo growth and prosper.

In India, the banking sector is relatively stable. Economic targets like these will serve as the impetus for banks and other lending institutions to broaden their financing scope and appetite to cater to the needs of hungry, growing businesses. As a result of the accomplishments and development of digital payments and enhancements in the credit sector, the trade finance sector is poised to meet a rising demand for working capital. As seen in the last decade, the Indian government has supported and strengthened initiatives that have improved access to credit and payment infrastructure in the country. The government's sharp increase in capital expenditure can be viewed both as a demand-enhancing activity as well as a supply-enhancing one as it is creating infrastructure capacity for future growth and development.

Because the government is keen to support Indian business, it decided that all non-banking financial institutions would be allowed to take on factoring services, also known as post-shipment financing, rather than only specialty factoring companies. This move is intended to provide an even broader ecosystem for factoring in India and help businesses significantly by opening up further avenues for credit.

After China, India has the world's largest MSME base. They contributed 30% to India's GDP, 45% to its manufacturing, and 40% to its exports. Unlike banks, alternative trade finance companies such as Tradewind are aware of and understand regulatory requirements in the jurisdictions that they operate in; this enables them to apply credit policies to clients that banks would use, but with an eye to finding creative and resourceful solutions for their clientele. Additionally, foreign factoring companies such as Tradewind possess specialized knowledge of the underlying business that is very unlikely to be replicated by a traditional financial institution.

The credit environment in which we operate is very positive. It grants opportunities for exporters and importers to connect with trade finance funders from other markets who would be more willing to examine the transaction, who have experience assessing risks in different types of transactions, and who might feel more comfortable providing funding. This will make it easier for Indian exporters to access foreign currency loans from a trusted, established international lender, such as Tradewind, and not just from their existing Indian lenders who have limited financing expertise, experience, and exposure to foreign markets, such as the EU, US, and the Middle East.

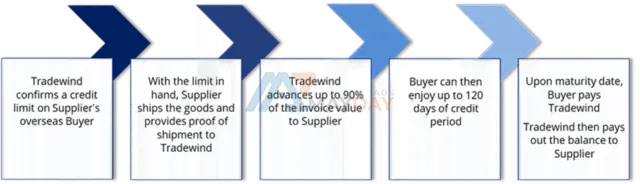

Here’s a snapshot of how Tradewind offers post-shipment financing to Indian exporters:

Tradewind is dedicated to providing low-cost, collateral-free trade finance solutions to businesses looking for finance solutions to enable them to trade sustainably and become more competitive in the global marketplace. Our goal is to offer Indian businesses practical trade-based solutions to help them expand their foreign trade and diversify their lending sources.

To know more: https://www.tradewindfinance.com/news-resources/the-case-for-international-trade-and-post-shipment-financing-in-india